SIGNIFICANT FARM-IN AGREEMENT WITH OZ MINERALS WOLLOGORANG PROJECT, NT

WATCH MD DUNCAN CHESSELL DISCUSS THE NEW FARM-IN AGREEMENT WITH OZ MINERALS

Executive Summary:

• Resolution Minerals Ltd and OZ Minerals Limited (ASX: OZL) enter into a Farm-in and JV agreement on the Wollogorang Copper Project in the Northern Territory, Australia

• OZL can earn a 51% interest by spending ~$4.9m over 5 years

• RML may retain 49% interest by electing to participate from year 6

• If RML elects not to participate, OZL has the option to earn a 75% interest, by sole-funding and delivering a Positive Final Investment Decision to Mine (at a minimum spend of

$1m/year, OZL has a further 5 years to complete)

• Resolution remains Operator during the Earn-in period with technical input from OZL

“This is a very exciting development for Resolution’s shareholders. Copper is a fundamental ingredient to the renewable energy future of the planet. Resolution Minerals is very pleased to be a partnering with copper focussed producer OZ Minerals, to explore together for copper at Resolution’s Wollogorang Project in the Northern Territory.

The JV agreement with OZ Minerals, is recognition of the copper prospectivity of the Wollogorang Project. In particular the results of our recent air-borne VTEM geophysics survey that identified dozens of untested conductors and highlighted the sedimentary hosted copper potential of the project. The partnership with OZ Minerals has secured long-term funding, technical exploration collaboration and mining expertise to explore the current identified targets with potential to discover the next large-scale copper mine in the Northern Territory. The 25% carried interest for Resolution to decision to mine is a significant value add for RML shareholders without dilution.

The Wollogorang Project is located within the McArthur Basin which hosts the world class McArthur River lead-zinc Mine and is surrounded by mid-tier and major companies including BHP, Rio Tinto and Teck. The Northern Territory ranks in the Top 20 of the best mining jurisdictions in the world by the Fraser Institute (2020) and is relatively underexplored. RML recognises the potential within the Northern Territory to host large scale undiscovered mines.

This Agreement allows Resolution to advance two major projects simultaneously – the other being the 64North Gold Project in Alaska which surrounds Northern Star’s (ASX: NST) 11Moz Pogo Gold Mine – putting the company in a very strong position as a junior explorer.”

Managing Director, Duncan Chessell

Details

Resolution Minerals is pleased to announce the execution of a significant, multi-year farm-in and joint venture agreement with copper focussed mid-tier mining company, OZ Minerals Limited (ASX: OZL). The agreement will allow RML and OZL to fast-track the search for copper discoveries on Resolution’s Wollogorang Project (Project), located in the McArthur Basin in the Northern Territory.

OZ Minerals is a modern mining company that’s focused on creating value for all its stakeholders. As one of Australia’s largest copper producers, OZ Minerals owns and operates the Prominent Hill and Carrapateena mines in South Australia. Collaboratively OZ Minerals and Resolution have a strong commitment to safety.

Exploration strategy

Resolution’s approach is to use modern geophysics to identify large scale sediment-hosted stratiform copper mineralisation within two McArthur Basin Formations (Wollogorang Formation & Gold Creek Volcanics Formation). Both Formations contain reductive units, which are prospective trap sites for sediment-hosted stratiform copper mineralisation. Previous explorers focussed on discrete breccia pipes, such as the Stanton Cobalt Deposit, which demonstrated the presence of copper and cobalt in the system. However, these breccia pipes are not of sufficient scale to warrant further attention on RML’s tenements currently.

Resolution recently completed a ~2,000 line-kilometre airborne VTEM geophysics survey on the eastern half of the project and identified 40 conductors, 37 untested by drilling (see this ASX announcement for the full VTEM results). VTEM surveys can detect sub-surface conductive bodies to 400m such as massive base metal sulfides directly and other potential trap sites for base metals. The 40 conductors identified, have been ranked on the VTEM geophysics characteristics on a scale from 1 to 3. Combining the VTEM results (conductors) with a new litho-structural interpretation will allow Resolution to rank the geophysical results against geological context and logistical considerations.

It is highly likely further drill targets will be refined from this ongoing interpretation of the VTEM results in collaboration with OZL. The Company intends to update investors once this has been completed.

Material Terms of the Agreement

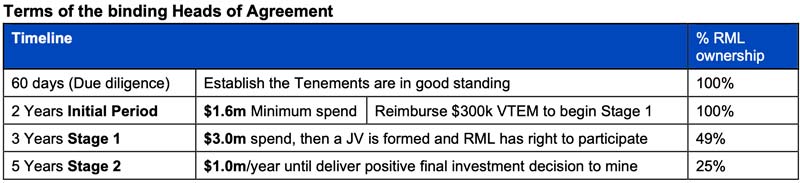

Resolution Minerals Ltd, through its wholly owned subsidiary, Mangrove Resources Pty Ltd (Mangrove), entered into a binding Heads of Agreement – Farm-in and Joint Venture – Wollogorang Project with OZ Exploration Pty Ltd (OZE), a wholly owned subsidiary of OZ Minerals Ltd (OZL) (Agreement).

Under the Agreement, OZL can earn from Mangrove up to a seventy-five per cent (75%) legal and beneficial interest in the mineral exploration tenements, EL30496, EL30590, EL31272, EL31546, EL31548, EL31549 and EL31550 (Wollogorang Project or Tenements), in the Northern Territory.

To earn a 51% interest in the Wollogorang Project OZL is required to undertake exploration activities of $1.6m over an initial 2-year period (Minimum Commitment), a further $3.0m expenditure over a 3-year period (Stage 1) as well as paying Resolution $0.3m for the VTEM survey undertaken by the Company in mid-2021. A formal joint venture agreement (in line with industry standard terms) may be formed from the point that OZL earns a 51% interest in the Project.

If OZL doesn’t spend $4.9m within the 5-year period (to end of Stage 1), Resolution retains a 100% interest. Resolution can elect to contribute at 49% interest (initial JV formed) or 25% interest following Positive Financial Investment Decision (PFID). If OZL elects to discontinue sole funding after having reached a 51% interest, OZL transfers 2% interest to RML for $1, and RML becomes the 51% owner and manager with OZL diluting.

To earn a 75% interest in the Wollogorang Project, OZL must expend at least $1m per year over a further 5-year period to PFID. If either party’s interest dilutes to below 10% that party’s interest converts to a 2% NSR. OZL can accelerate earning to any milestone by meeting the expenditure requirements early. Over-spend in any stage is carried forward to the next stage.

The voracious appetite for copper, cobalt, nickel, aluminium and other battery metals required to convert the world from fossil fuels to green electrical alternatives is now a short-medium and long term reality.

MORE NEWS FROM THE WOLLOGORANG PROJECT View all