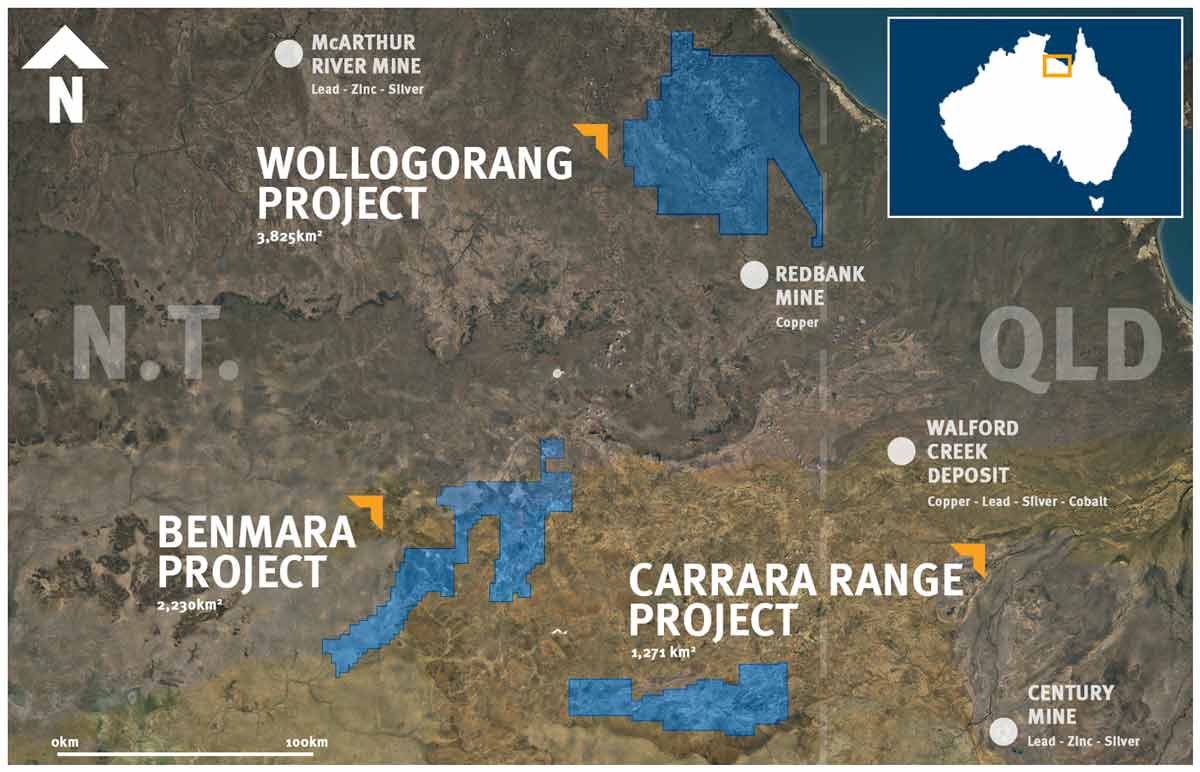

CARRARA RANGE BATTERY METAL PROJECT ACQUISITION

Summary

-

Binding term sheet to acquire 100% of Carrara Range Project, Northern Territory

-

Prospective for battery metals and iron ore. Covering 1,271 km2 in the South Nicholson Basin

-

Complementary to Resolution’s nearby Benmara and Wollogorang Projects and aligned with the

Company’s battery-metals focus in Australia

-

Geoscience Australia recently identified a manganese mineral occurrence within the project area, untested by drilling, highlighting the underexplored and prospective nature of the project

-

Detailed project review underway to plan and prioritise initial on ground activities this dry season

-

Results of review and exploration plans will be announced in early March for all NT Projects

"The Carrara Range Project is complementary to our nearby Benmara & Wollogorang Projects, and is highly prospective for sediment hosted battery metals. The geographic location will allow RML to focus our Australian exploration efforts on battery metals in the Northern Territory. The area is underexplored and only recently (2020), Geoscience Australia geologists identified a new promising manganese mineral occurrence at surface. We are very excited to get out and explore this coming dry season for the next world-class McArthur River Mine on these three excellent battery metal projects in the Northern Territory."

- Managing Director Duncan Chessell

Details

Resolution Minerals Ltd (ASX: RML) is pleased to announce that it has signed a binding term sheet with private company Cientifica Pty Ltd (Vendor) to Purchase a 100% interest in six exploration tenements (3 granted, 3 in application) covering a total area of 1,271 km2 in the Northern Territory. Upon completion, Resolution will hold a 100% unencumbered interest in the tenements: EL32622, EL32620, EL32577, EL32621, EL32619 and EL32578.

The Carrara Range Project is prospective for sediment hosted battery metals including Mn-Cu- Ag-Pb-Zn-Co as well as iron-ore. The share-based terms of the deal will preserve Resolution’s cash for exploration activities to best increase shareholder value.

Transaction Details

The Consideration for the Outright Purchase is $20,000 cash and 2,000,000 RML shares up front (Tranche 1) and a further 7,000,000 RML shares upon transfer of the title of the tenements (Tranche 2) (subject to Ministerial approval). The shares will be issued under RML’s 15% placement capacity under Listing Rule 7.1 within 7 business days of execution for Tranche 1, and within 7 business days of transfer for Tranche 2. All shares will be subject to voluntary escrow for 12 months from issue.

Completion will be subject to a number of standard conditions precedent (if required), including: Ministerial consent and other conditions precedent usual for this type of transaction.

MORE FROM RML'S BATTERY METALS PROJECTS View all